Underrated Ideas Of Tips About Profit & Loss Statement Format In Excel

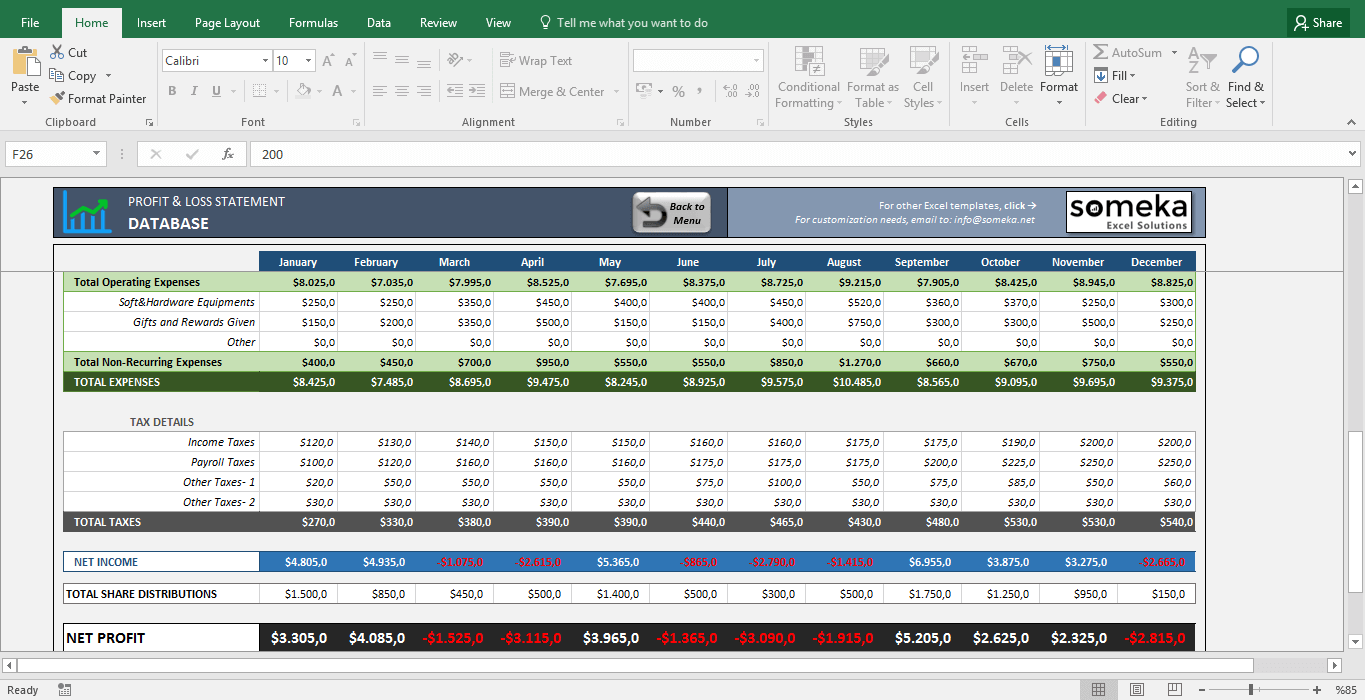

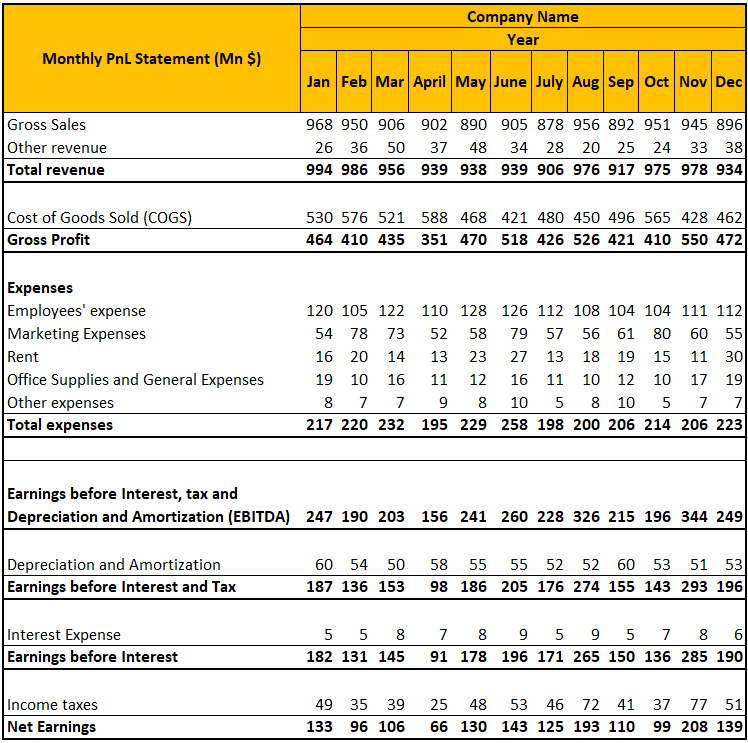

Excel pivottable profit and loss step by step instructions.

Profit & loss statement format in excel. Just enter your data into the template then analyze it to evaluate total. The simplified formula is: For additional resources and tutorials,.

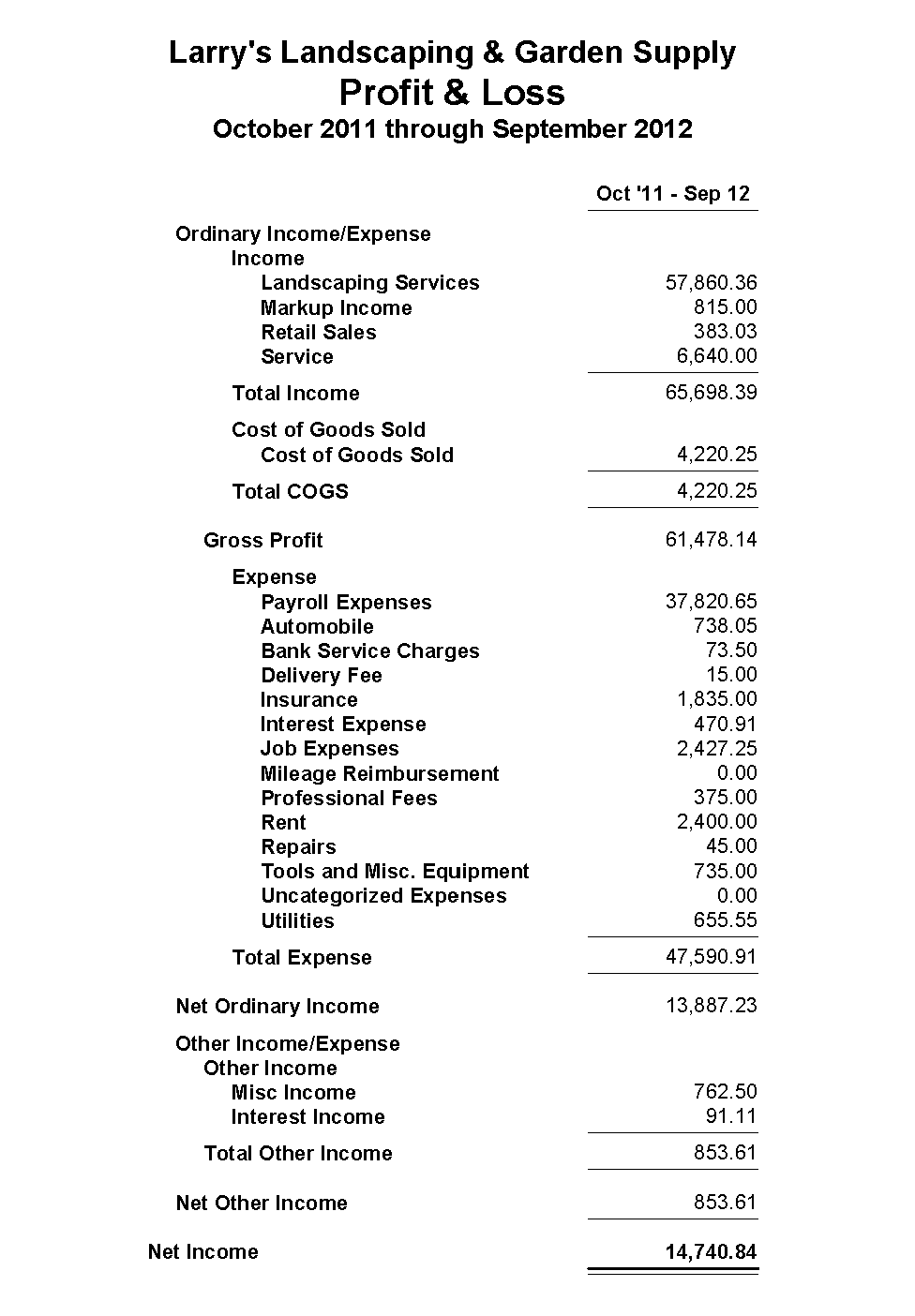

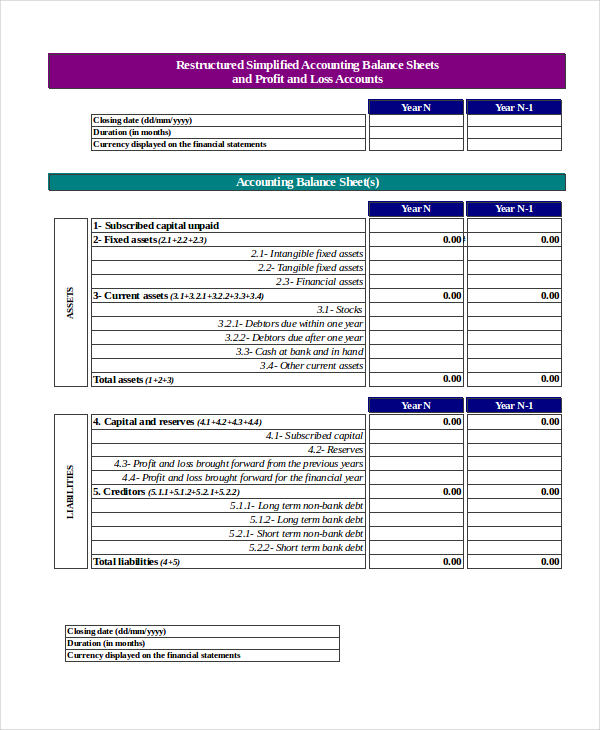

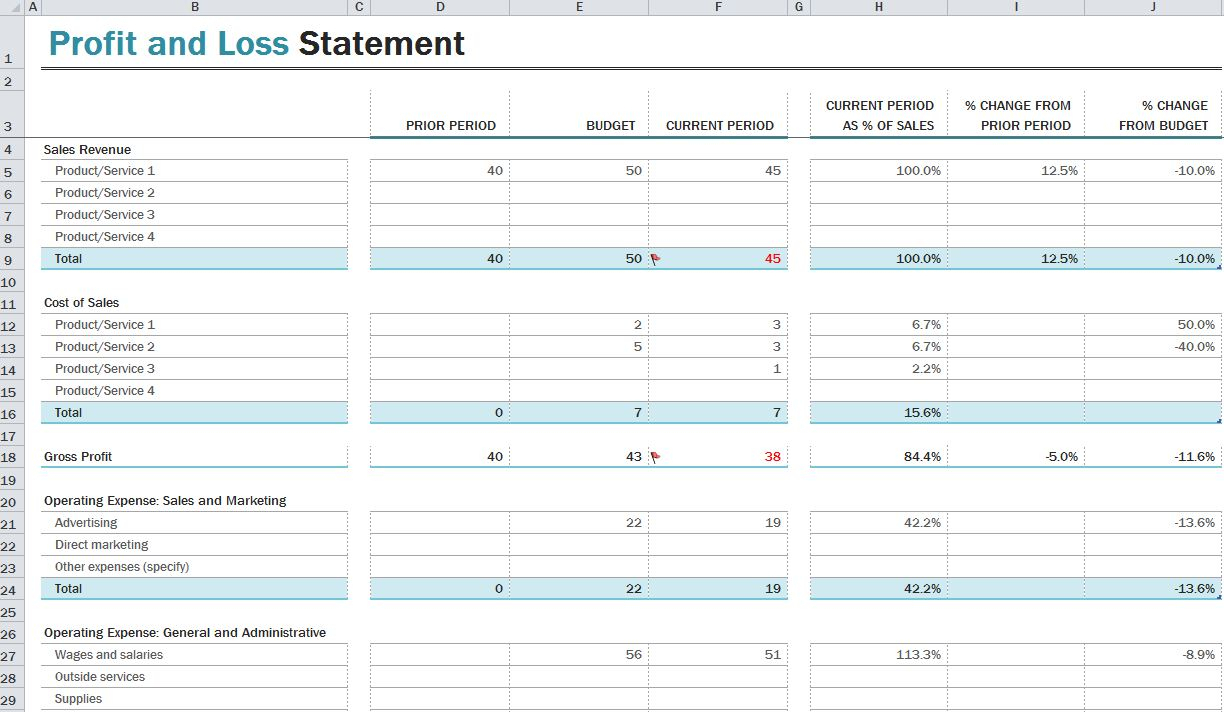

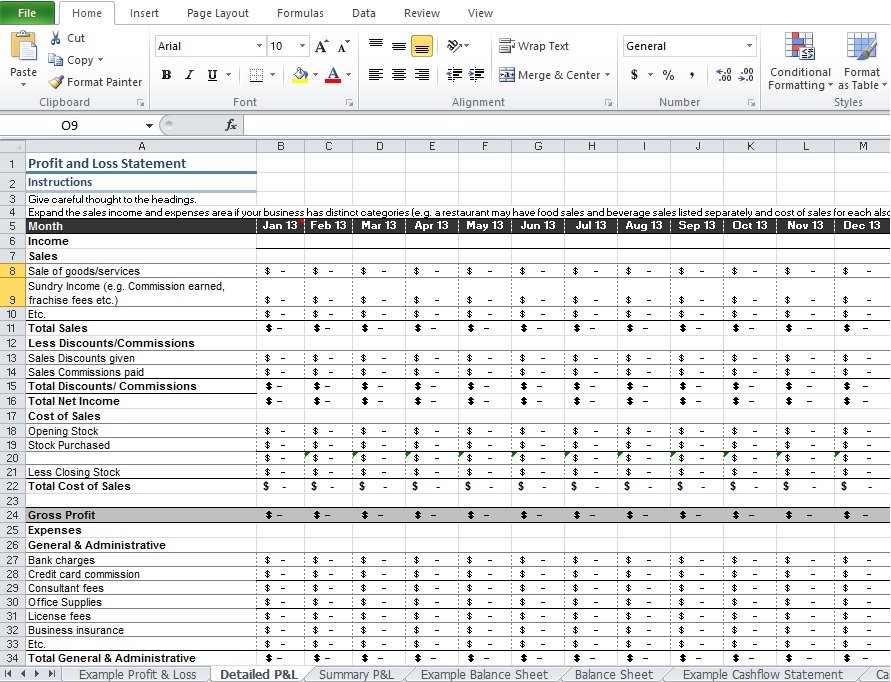

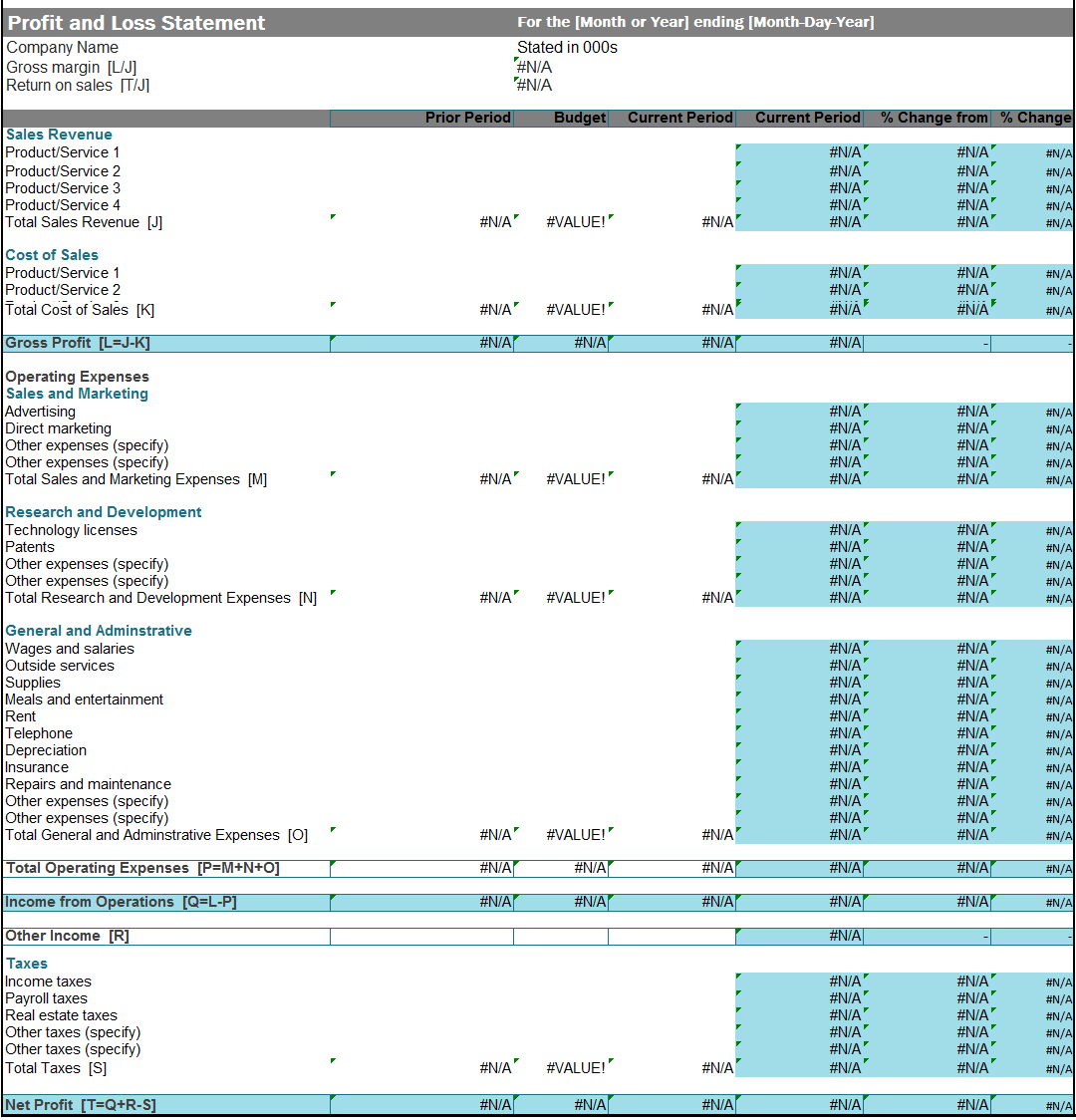

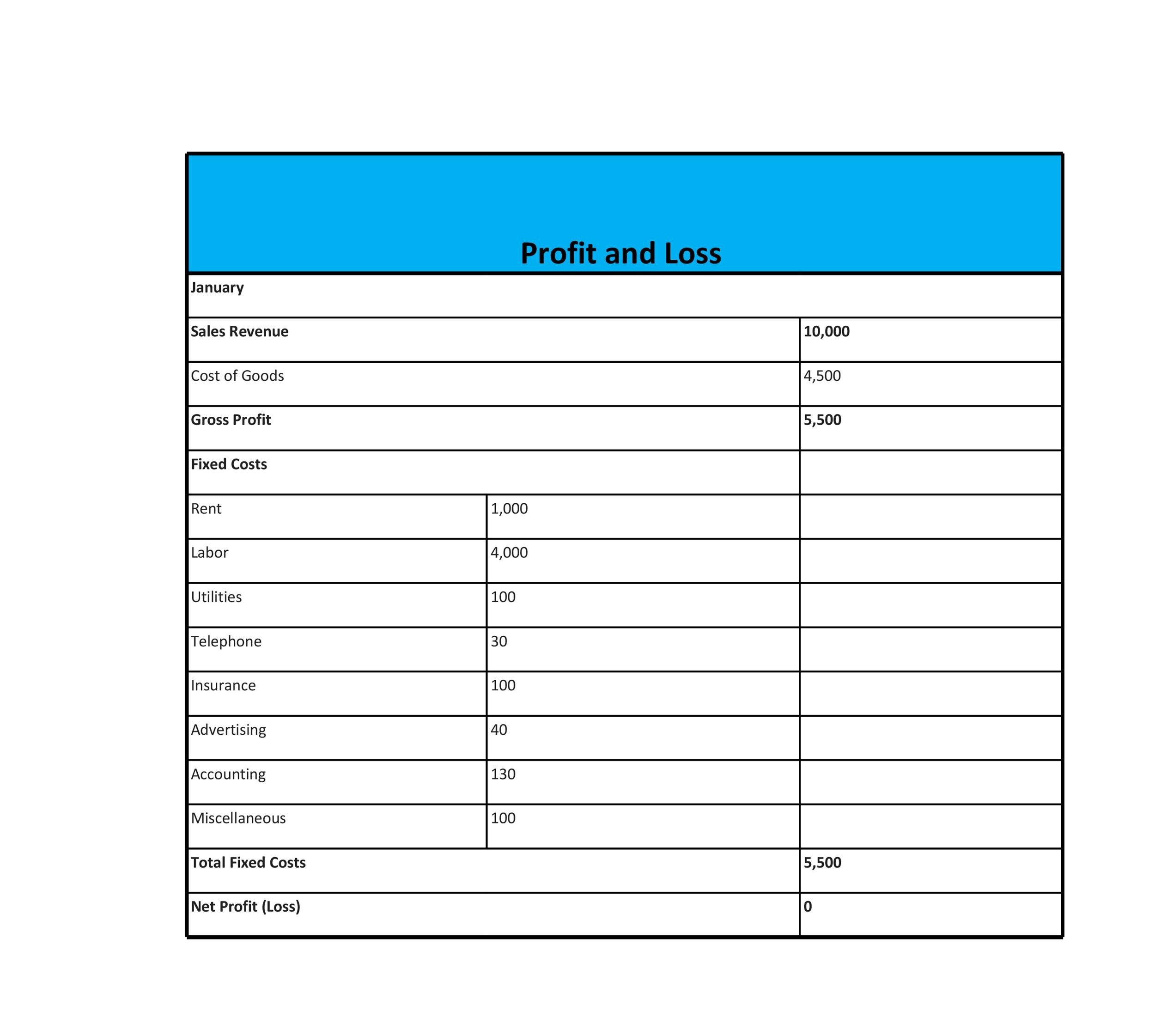

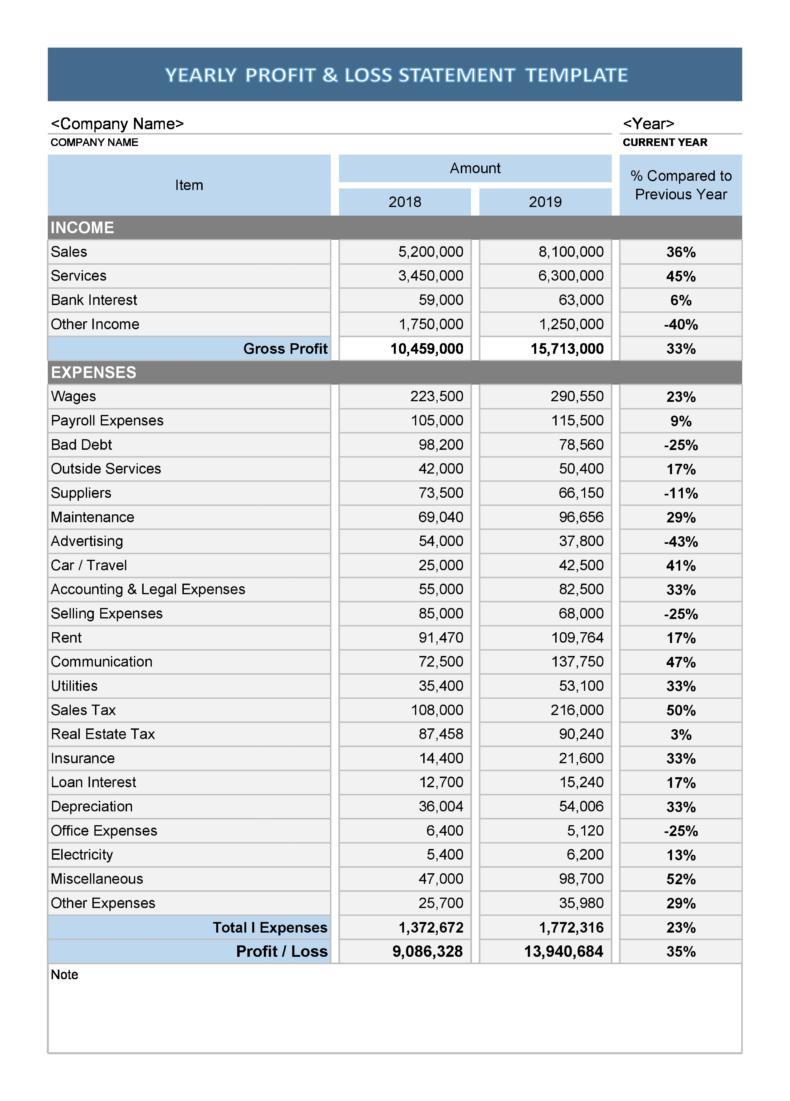

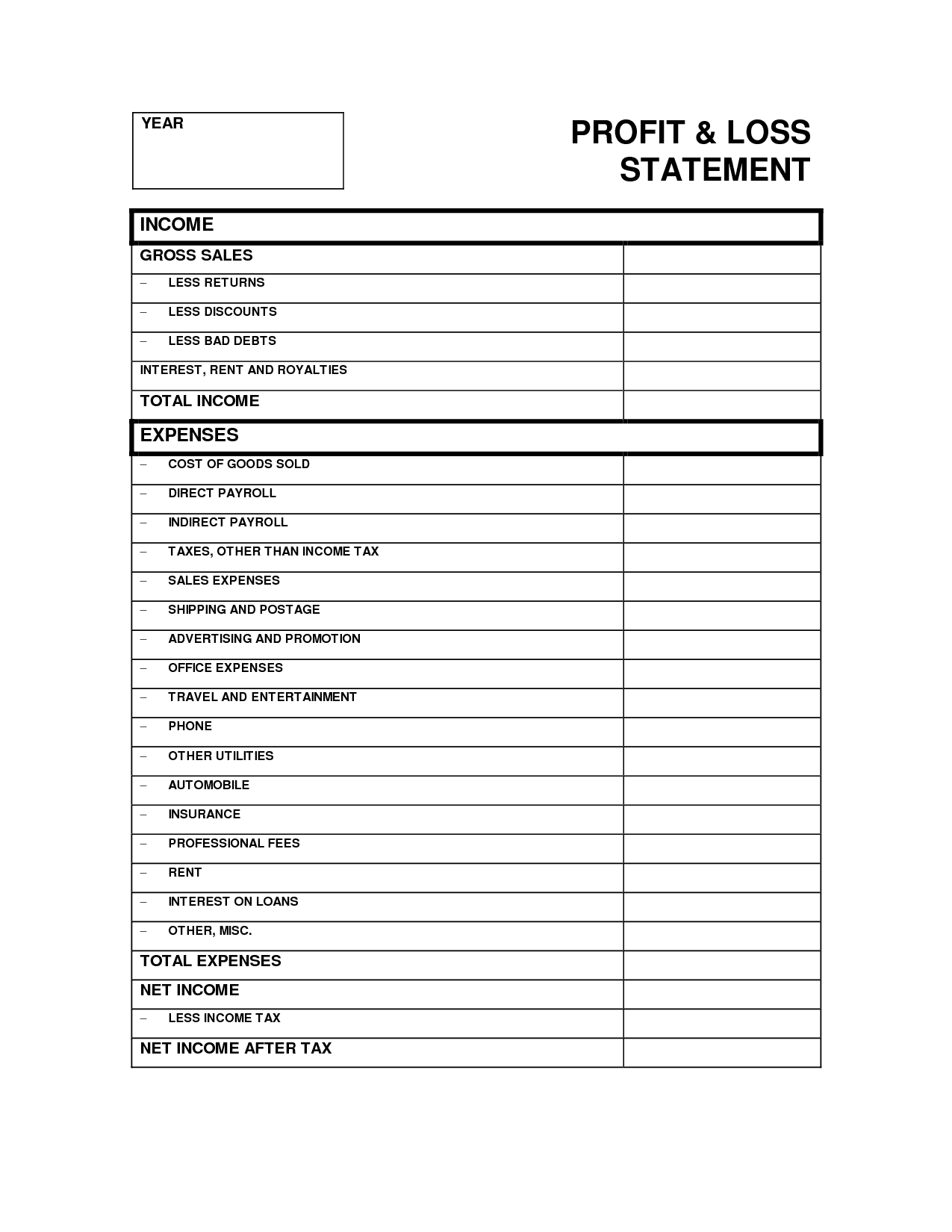

04 (profit and loss statement free template for excel) format no. It provides an overview of earnings, outlays, and costs for a given time. What’s a p&l statement?

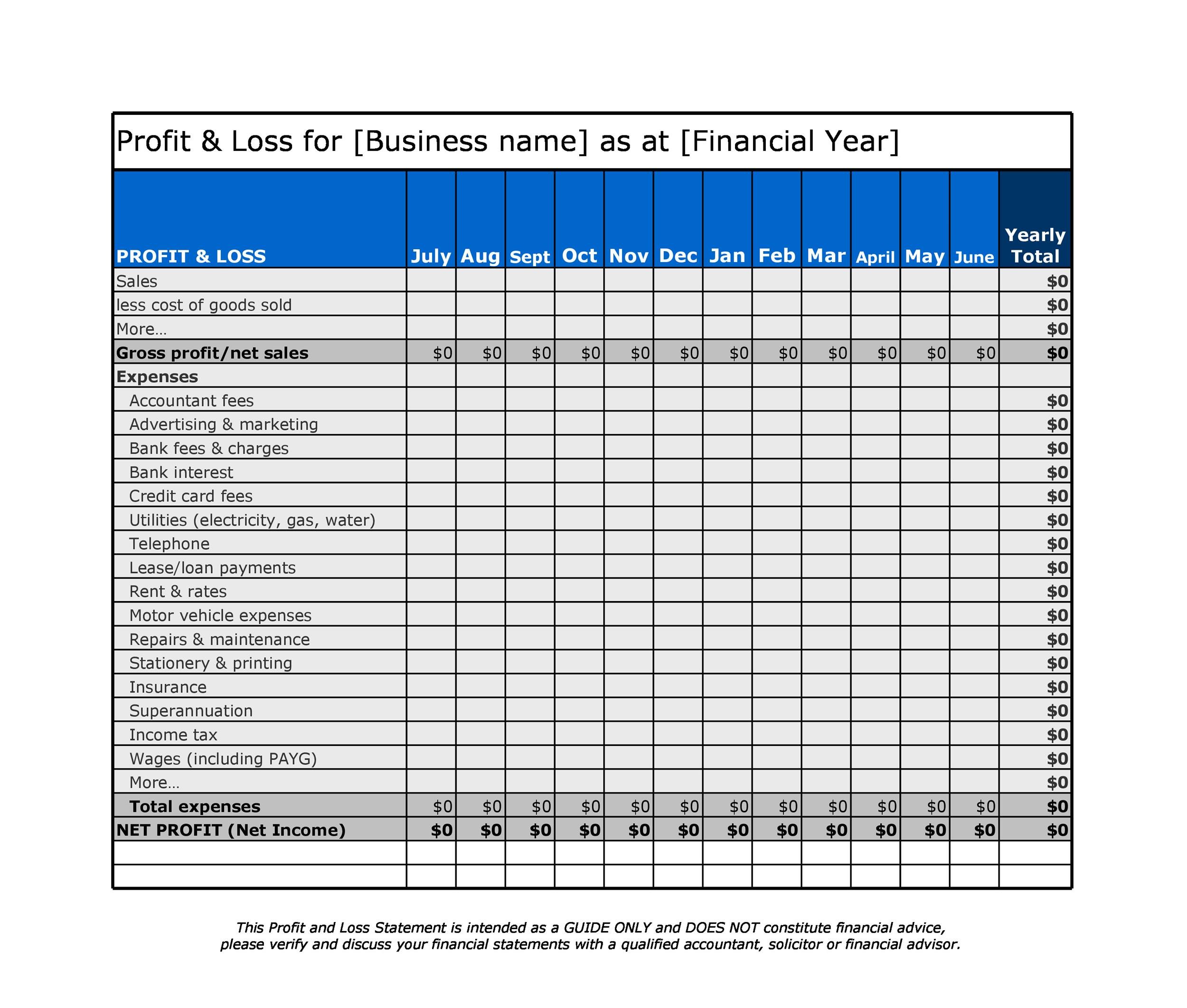

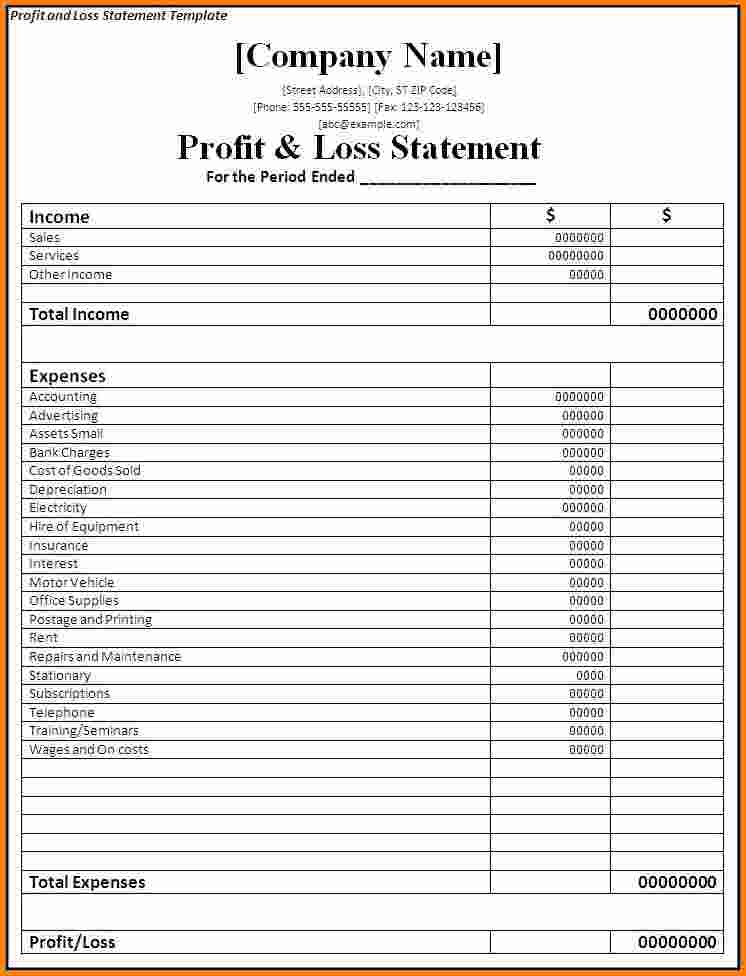

17+ excel profit and loss templates both small and large businesses need profit and loss excel templates for financial accounting for a particular period, usually semi. The template includes sample line items with common income sources and expenses. Our tutorial breaks down the process of creating a profit and loss statement in excel for small businesses into three easy steps, so you can get started using our customizable templates.

Here is the preview of profit and loss statement format download in excel profit and loss statement format. Creating a profit and loss statement in excel: My data (shown below) is in a tabular layout with each account classified into an ‘account group’.

One type of financial report is the profit and loss (p&l) statement. Profit and loss statement free template for excel. This can often be exported from an accounting system like quickbooks, oracle,.

It provides a clear picture of the company's revenue,. Now, let’s explore the steps to create a p&l statement in excel, along with some hacks to streamline the process:. Introduction creating a profit and loss (p&l) statement is crucial for businesses to track their financial performance.

A profit and loss statement is an important way of working out not only how your business has been performing in the past, but for predicting how it will perform in the future. 06 (sample profit & loss. 05 (simple profit loss template in excel) format no.

Profit and loss percentage formula from cost price and sell price in this method, we will use the mathematical formula subtraction to simply get the.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Hotel-Profit-Loss-Statement-Template-TemplateLab-scaled.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Monthly-Profit-Loss-Statement-Template-TemplateLab-scaled.jpg)