Best Of The Best Tips About Irregular Income Planning Sheet

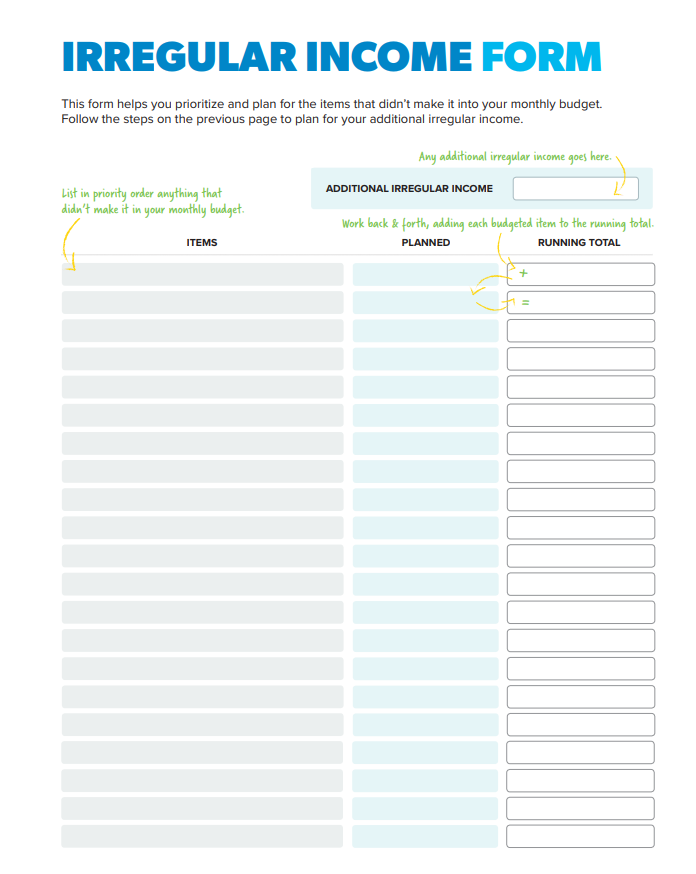

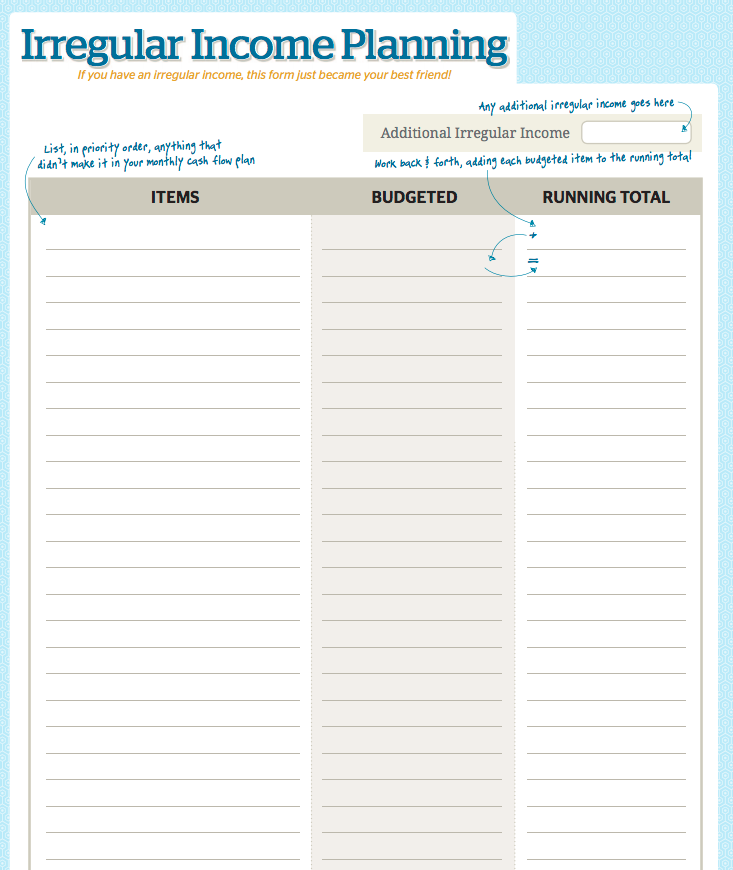

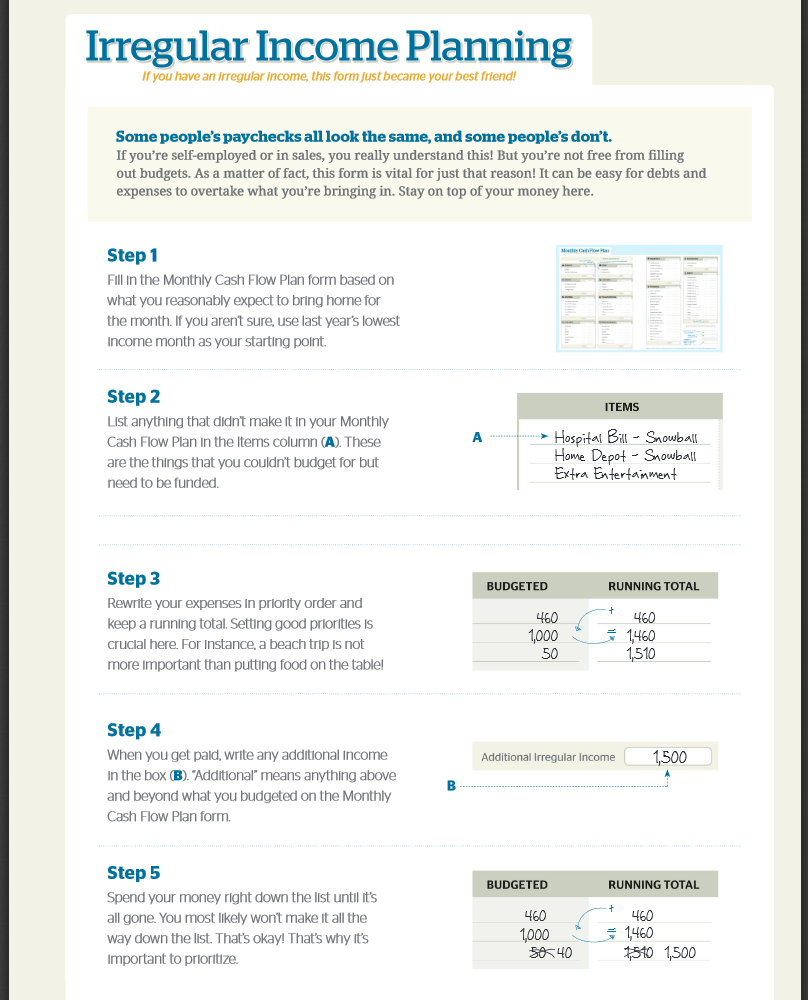

Irregular income planning form.

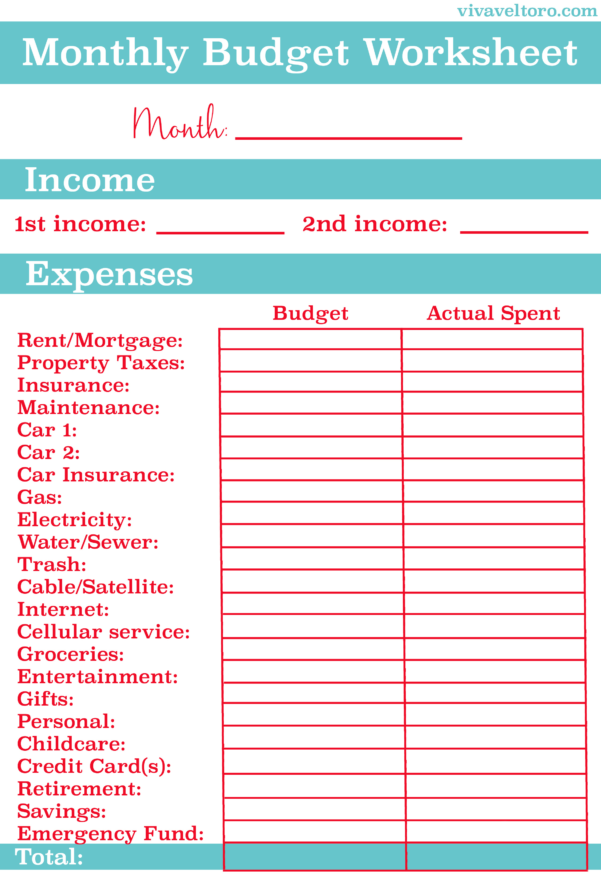

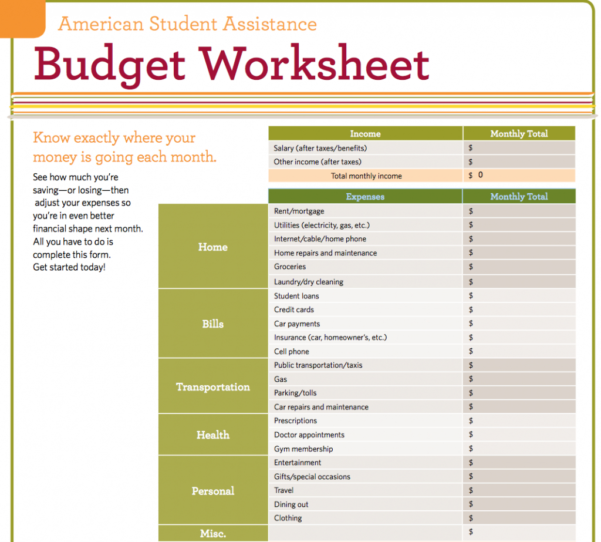

Irregular income planning sheet. List your irregular expenses and add the average to your spending. This form outlines dave's recommended percentages for each category, making it easier to set up. Excel’s range of free and paid budgeting templates will help you get prepared and on schedule while establishing a budgeting plan for your income, which can feel daunting and difficult.

The answer is an irregular income budget. Sheet 8 irregular income planning many of us have irregular incomes. Edit, fill, sign, download irregular income planning form online on handypdf.com.

There are three essential steps that you need to follow to set up a realistic working budget when you have irregular income. To determine it, look back at. In the left column, you enter your planned monthly budget.

In other words, the budget you'd like to stick to if your income allows it that month. It’s way better to start low than to start with an average. You should still do all the sheets except sheet 7.

Unlike a steady paycheck, incomes that fluctuate require extra planning. I like to call this “knowing your starting point.” when your income is predictable, you usually budget your money by creating spending categories within that limit. 2.) next starting in cells b4 and c4, prioritize your budget items starting with the most important items first.

Because if you budget low, you can always go up from there. While this makes it more dificult to predict your income, you are still responsible for doing a monthly budget! Download recommended percentages how much do you need to budget for groceries?

This means that you’ll want to create a budget based on your lowest monthly income estimate. You can adjust later in the month if you make more. Globally, cervical cancer is the fourth most common cancer in women, with 604 000 new cases in 2020.

One of the most difficult aspects of budgeting is when you have to budget with an irregular income. Below is the exact budget worksheet i use to budget with irregular income. You don’t get regular paychecks every two weeks.

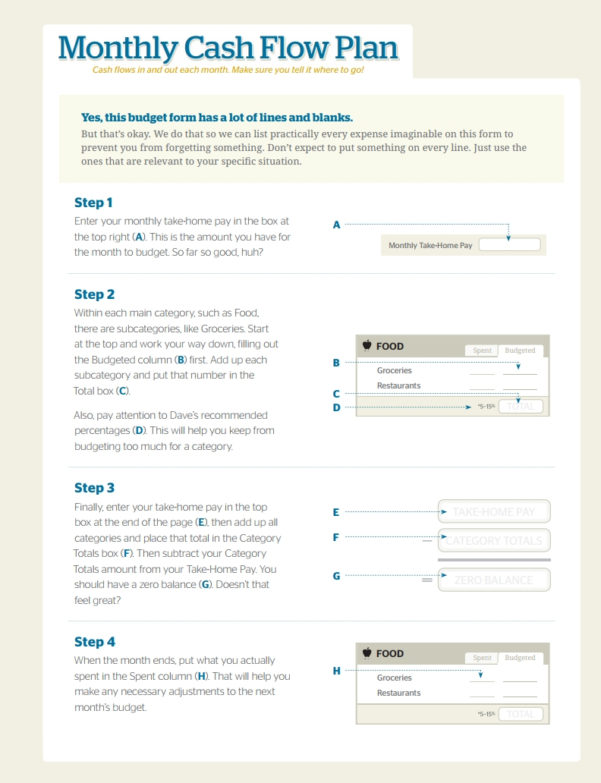

(we’ve got a special irregular income budget template if you need it.) now, add it all up and write in your total. The first step is to figure out how much money you actually take home each month (after tax income). (instructions) many people have an “irregular” income, which simply means that their compensation fluctuates from month to month.

If you earn irregular income, your best option is to plan low. Step 1 fill in the monthly cash flow plan form based on what you reasonably expect to bring home for the month. It also gives you peace of mind.